Unlocking the Vault: Exploring Your Business Financing Options

When it comes to starting or growing a business, one of the biggest challenges that entrepreneurs face is securing the necessary funding. Whether you’re looking to launch a new product, expand your operations, or simply keep your business afloat during tough times, having access to the right financing options is crucial. In this article, we’ll explore some of the key financing options available to small business owners, and how you can unlock the vault to find the funding you need.

One of the most common forms of business financing is a traditional bank loan. Banks offer a variety of loan products tailored to the needs of small businesses, including term loans, lines of credit, and SBA loans. While bank loans can be a good option for businesses with strong credit and a solid track record, they can also be difficult to qualify for, especially for new businesses or those with less-than-perfect credit.

Another popular financing option is a business credit card. Business credit cards offer a convenient way to access funds quickly and easily, and can be a great tool for managing cash flow and covering short-term expenses. However, it’s important to use business credit cards responsibly, as high interest rates and fees can quickly add up if you carry a balance.

For businesses in need of more substantial funding, venture capital and angel investing can be a good option. These types of investors provide funding in exchange for equity in your business, and can bring valuable expertise and connections to the table. However, landing a venture capital or angel investment can be a competitive process, and you’ll need a solid business plan and a compelling pitch to attract investors.

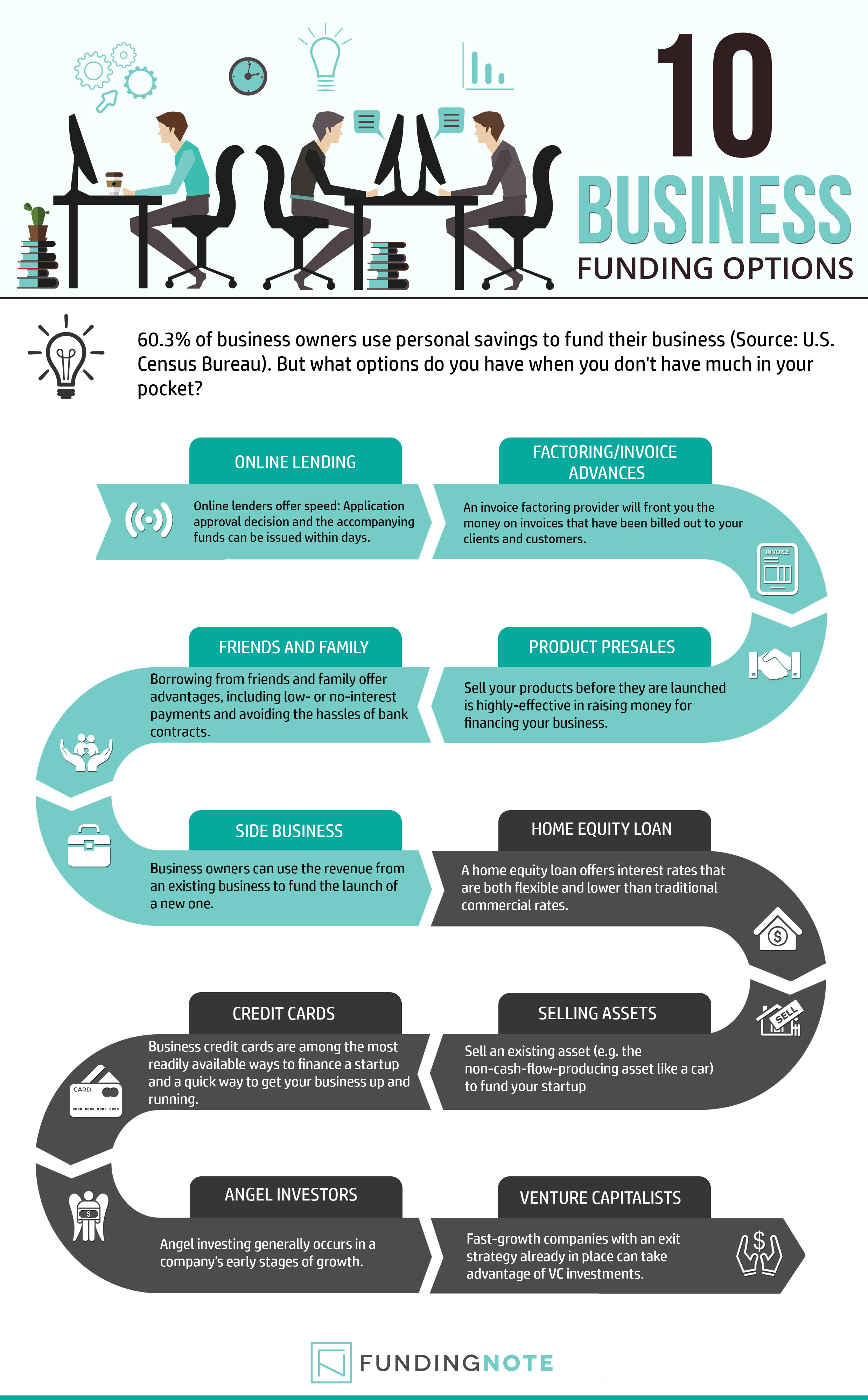

Image Source: fundingnote.com

If you’re looking for a more flexible financing option, crowdfunding may be worth considering. Crowdfunding platforms like Kickstarter and Indiegogo allow you to raise funds from a large number of individual backers, often in exchange for rewards or pre-orders of your product. Crowdfunding can be a great way to test the market for your idea and build a community of loyal customers, but it can also be a lot of work to run a successful campaign.

For businesses with valuable assets like equipment or real estate, asset-based lending can be a good financing option. With asset-based lending, you use your assets as collateral to secure a loan, which can be a lower-risk option for lenders and can allow you to access larger amounts of funding than you might qualify for with a traditional loan.

Finally, if you’re looking for a more hands-on approach to financing, consider bootstrapping your business. Bootstrapping involves funding your business with your own savings and revenue, rather than relying on external financing. While bootstrapping can be a challenging path, it can also give you greater control over your business and allow you to grow at your own pace.

In conclusion, there are a wide variety of financing options available to small business owners, from traditional bank loans to crowdfunding and everything in between. By exploring these options and finding the right fit for your business, you can unlock the vault to secure the funding you need to take your business to the next level. So don’t be afraid to explore your options, get creative with your financing strategy, and take your business to new heights!

From A to Z: Navigating the World of Funding Sources

When it comes to financing your business, the options can seem overwhelming. From traditional bank loans to crowdfunding platforms, there are countless ways to secure the funding you need to grow your business. In this article, we will explore the ABCs of business financing and guide you through the various funding sources available to entrepreneurs.

A is for angel investors, who are wealthy individuals who provide capital to start-ups in exchange for ownership equity or convertible debt. These investors can offer valuable mentorship and connections in addition to funding, making them a popular choice for early-stage companies looking to scale quickly.

B is for bank loans, a more traditional form of financing where a business borrows money from a financial institution and repays it over time with interest. While bank loans can be a reliable source of funding for established businesses with strong credit histories, they can be difficult to secure for start-ups or companies with limited collateral.

C is for crowdfunding, a popular method of raising capital by soliciting small contributions from a large number of people, typically via online platforms such as Kickstarter or Indiegogo. Crowdfunding allows businesses to validate their ideas, generate buzz, and raise funds without giving up equity or taking on debt.

D is for debt financing, where a business borrows money from a lender and agrees to repay it with interest over a set period of time. Debt financing can take many forms, including traditional bank loans, lines of credit, and merchant cash advances, and can be a viable option for businesses looking to fund specific projects or expenses.

E is for equity financing, where a business sells ownership stakes in exchange for capital. This can involve selling shares to investors or partnering with venture capitalists or private equity firms. While equity financing can be a valuable source of funding for businesses with high growth potential, it often means giving up some degree of control over the company.

F is for friends and family, a common source of funding for entrepreneurs who may not qualify for traditional loans or investments. While borrowing money from loved ones can be a quick and easy way to get started, it’s important to approach these arrangements with caution and clear communication to avoid straining relationships.

G is for grants, which are non-repayable funds provided by governments, foundations, or other organizations to support specific projects or initiatives. Grants can be a valuable source of funding for businesses working in certain industries or pursuing social or environmental goals, but they often come with strict eligibility criteria and reporting requirements.

H is for hard money loans, a type of short-term financing secured by real estate. Hard money loans are often used by real estate investors or developers who need quick access to capital and are willing to pay higher interest rates in exchange for faster approval and funding.

I is for IPOs, or initial public offerings, where a privately held company offers shares of its stock to the public for the first time. IPOs can be a lucrative source of funding for well-established companies looking to raise capital for expansion or acquisitions, but they require extensive preparation and compliance with regulatory requirements.

J is for joint ventures, where two or more businesses collaborate on a specific project or venture and share the risks, costs, and rewards. Joint ventures can be a strategic way to access new markets, technologies, or resources without taking on full ownership or control, but they require clear agreements and communication to ensure success.

K is for kickstarter campaigns, a type of crowdfunding where entrepreneurs raise funds for creative projects or products by offering rewards or incentives to backers. Kickstarter campaigns can be a fun and interactive way to engage customers, generate buzz, and raise funds for new ideas or innovations.

L is for lines of credit, a flexible form of financing where a lender provides a business with a maximum credit limit that can be drawn upon as needed. Lines of credit can be a convenient source of working capital for businesses with fluctuating cash flow or seasonal expenses, allowing them to access funds quickly and repay only what they use.

M is for microloans, small loans typically ranging from a few hundred to a few thousand dollars, provided by non-profit organizations or community lenders to support small businesses and entrepreneurs. Microloans can be a valuable source of funding for start-ups or businesses in underserved communities, offering low-interest rates and flexible repayment terms.

N is for non-dilutive financing, where a business raises capital without giving up equity or taking on debt. Non-dilutive financing can take many forms, including grants, competitions, sponsorships, or strategic partnerships, and can be a valuable alternative to traditional funding sources for businesses looking to preserve ownership and control.

O is for online lenders, which provide small business loans through digital platforms that use algorithms and technology to streamline the application and approval process. Online lenders can offer fast and convenient access to capital for businesses with limited credit history or collateral, but they often come with higher interest rates and fees than traditional lenders.

P is for personal savings, a common source of funding for entrepreneurs who bootstrap their businesses by using their own money to cover start-up costs or expenses. While using personal savings can be a low-risk way to get started, it’s important to separate personal and business finances and to have a plan for replenishing savings as the business grows.

Q is for quiet investors, who provide funding to businesses without seeking publicity or public recognition. Quiet investors can offer valuable capital and expertise without the scrutiny or demands of more traditional investors, making them a discreet and strategic source of funding for businesses looking to grow under the radar.

R is for revenue-based financing, a form of financing where a business receives a lump sum of capital in exchange for a percentage of its future revenues. Revenue-based financing can be a flexible and scalable source of funding for businesses with steady cash flow, allowing them to repay the investment based on their performance and growth.

S is for SBA loans, small business administration loans backed by the U.S. Small Business Administration that provide funding to small businesses with favorable terms and rates. SBA loans can be a valuable source of financing for businesses that may not qualify for traditional bank loans, offering longer repayment terms and lower down payments.

T is for trade credit, where a business purchases goods or services on credit from vendors or suppliers and pays for them at a later date. Trade credit can be a valuable source of short-term financing for businesses with regular purchasing needs, allowing them to manage cash flow and inventory without tying up working capital.

U is for underwriters, who are financial professionals or institutions that assess the creditworthiness and risk of a business and help secure funding from investors or lenders. Underwriters play a critical role in the financing process, conducting due diligence, structuring deals, and negotiating terms to ensure that businesses receive the capital they need on favorable terms.

V is for venture capital, a type of private equity investment that provides funding to high-growth companies in exchange for equity stakes. Venture capital can be a valuable source of funding for start-ups or businesses with significant growth potential, offering not only capital but also expertise, connections, and strategic guidance to help them succeed.

W is for working capital loans, a type of short-term financing designed to help businesses cover day-to-day expenses or manage cash flow fluctuations. Working capital loans can be a valuable source of funding for businesses with seasonal or cyclical revenue patterns, allowing them to bridge gaps between payments and expenses and maintain operations.

X is for expansion financing, where a business secures funding to support growth, acquisitions, or new market opportunities. Expansion financing can take many forms, including bank loans, equity investments, or lines of credit, and can be a strategic way for businesses to capitalize on their success and take their operations to the next level.

Y is for yield-based financing, a form of financing where a business receives capital in exchange for a percentage of its future profits or revenues. Yield-based financing can be a flexible and performance-based source of funding for businesses with strong growth potential, allowing them to align their financing with their success.

Z is for zero-interest loans, a type of financing where a lender provides capital to a business without charging any interest or fees. Zero-interest loans can be a valuable source of funding for start-ups or businesses with limited cash flow, allowing them to access capital without incurring additional costs or debt.

In conclusion, navigating the world of funding sources can be a daunting task, but by understanding the ABCs of business financing and exploring the various options available, entrepreneurs can find the right funding sources to support their growth and success. Whether you’re looking for traditional bank loans, alternative financing options, or creative solutions like crowdfunding or grants, there are countless ways to secure the capital you need to take your business to the next level. So don’t be afraid to explore all your options and find the funding sources that work best for you and your business.

The Ultimate Guide to Business Funding Options